Technical Analysis: Trading Charts, Candles, and Patterns

This article discusses the basics in technical analysis; trading charts; and candles and patterns, necessary to know in world of trading assets of nay kind.

INTRODUCTION TO CRYPTO

CryptoTokin

5 min read

Introduction:

Technical analysis is a powerful tool used by traders to analyze historical price data and make informed decisions about future price movements. By studying charts, interpreting candlestick patterns, and identifying key trading patterns, traders can gain valuable insights into market trends and potential trading opportunities. In this comprehensive guide, we'll explore the fundamentals of technical analysis, including the basics of charts and candles, as well as specific trading patterns that can help traders navigate the financial markets with confidence.

Understanding Charts:

Types of Charts: There are several types of charts used in technical analysis, including line charts, bar charts, and candlestick charts. Each type has its advantages and is used to visualize price data in different ways.

Components of a Chart: Charts typically consist of price data plotted over a specific time frame, with the x-axis representing time and the y-axis representing price. Additional elements such as volume and indicators may also be included to provide additional context. We find indicators most valuable when reading charts. TradingView stands as a favored platform among traders and investors seeking to analyze financial markets and make informed trading decisions. Among the plethora of tools available, five key trading indicators commonly utilized on TradingView warrant attention.

Moving Average (MA): Acting as a trend-following indicator, the moving average calculates the average price of a security over a specified period, effectively smoothing out price fluctuations and illuminating trends. Traders leverage moving averages to discern trends, pinpoint support and resistance levels, and generate buy or sell signals, with variations like simple moving averages (SMA) and exponential moving averages (EMA) offering nuanced insights into price movements.

Relative Strength Index (RSI): As a momentum oscillator, the Relative Strength Index gauges the speed and change of price movements, signaling whether a security is overbought or oversold. Employed by traders to spot potential trend reversals and validate trend strength, RSI readings above 70 indicate overbought conditions, while readings below 30 denote oversold conditions, prompting traders to consider appropriate trading actions.

MACD (Moving Average Convergence Divergence): The MACD serves as a trend-following momentum indicator, measuring the difference between two moving averages, typically the 12-period and 26-period EMAs. Traders utilize the MACD to detect shifts in trend momentum, with the MACD line crossing above or below the signal line signaling potential buy or sell opportunities, respectively, while divergences between the MACD line and price may hint at trend reversals.

Bollinger Bands: These volatility bands, plotted above and below a moving average, typically the 20-period SMA, represent standard deviations of price volatility. Traders employ Bollinger Bands to identify overbought and oversold conditions and evaluate volatility levels. Narrowing bands suggest diminishing volatility, potentially preceding sharp price movements, whereas widening bands indicate escalating volatility and potential trading prospects.

Volume Profile: A charting tool displaying the volume traded at each price level over a specified period, Volume Profile furnishes insights into market dynamics and areas of support and resistance. By identifying significant price levels with substantial trading activity, known as volume-based support and resistance zones, traders analyze volume distribution to anticipate potential price reactions and validate trading decisions.

Introduction to Candlestick Patterns:

Anatomy of a Candlestick: Candlestick charts display price data in the form of candlesticks, with each candlestick representing a specific time period (e.g., one day). The body of the candlestick represents the opening and closing prices, while the wicks (or shadows) represent the high and low prices during the time period.

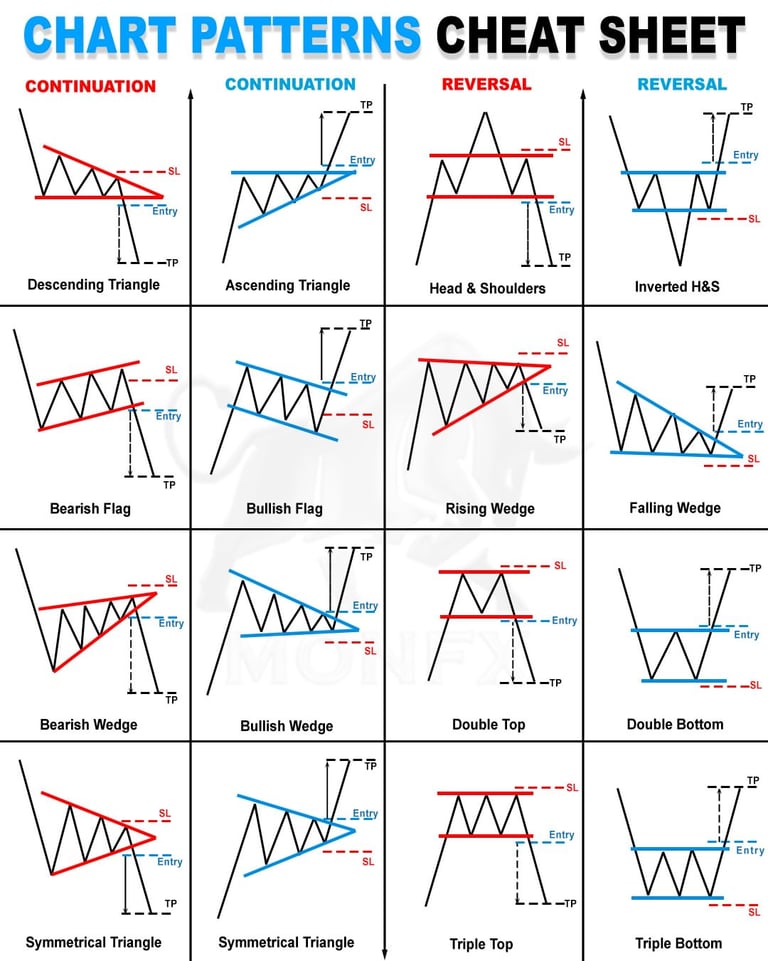

Common Candlestick Patterns: There are numerous candlestick patterns used in technical analysis to identify potential trend reversals or continuation patterns. Some common patterns include the Doji, Hammer, Shooting Star, and Engulfing patterns.

Basic Trading Patterns:

Support and Resistance: Support and resistance levels are key concepts in technical analysis, representing areas where price tends to find temporary support or encounter selling pressure, respectively. Traders often look for opportunities to buy near support levels and sell near resistance levels.

Trendlines: Trendlines are diagonal lines drawn on a chart to represent the direction and slope of a trend. An uptrend is characterized by higher highs and higher lows, while a downtrend is characterized by lower highs and lower lows. Trendlines can help traders identify potential entry and exit points in a trend.

Practical Application of Technical Analysis:

Chart Analysis Techniques: Traders use a variety of chart analysis techniques, including trend analysis, pattern recognition, and indicator analysis, and Fibonacci Sequence to identify potential trading opportunities and manage risk.

Risk Management: Managing risk is paramount in trading endeavors, serving to safeguard capital and mitigate potential losses. Traders must employ various risk management techniques to navigate the volatile nature of financial markets successfully. One crucial strategy is the implementation of stop-loss orders, which automatically exit trades at predetermined price levels to limit losses. Additionally, prudent position sizing ensures that each trade represents a manageable portion of the trader's capital, reducing the impact of adverse market movements. Moreover, maintaining favorable risk-reward ratios, where potential profits outweigh potential losses, is integral to sustainable trading strategies. By integrating these risk management principles into their trading routines, traders can cultivate resilience and longevity in their endeavors while striving for consistent profitability.

Continuous Learning and the Future: Technical analysis is a skill that requires continuous learning and practice. Traders should stay updated on market developments, experiment with different strategies, and learn from both successes and failures. In the realm of cryptocurrency trading, AI (Artificial Intelligence) and automated bots are revolutionizing the landscape, offering traders powerful tools to analyze data, execute trades, and optimize strategies with unparalleled speed and precision. AI algorithms sift through vast volumes of market data, identifying patterns, trends, and anomalies that human traders might overlook. These insights enable AI-powered bots to execute trades with split-second timing, capitalizing on market opportunities and minimizing risk exposure. Automated bots can operate 24/7, tirelessly monitoring markets and executing predefined trading strategies without succumbing to human emotions or fatigue. Moreover, AI-driven bots can adapt to changing market conditions in real-time, dynamically adjusting strategies to maximize returns and mitigate losses. While AI and automated bots have democratized access to sophisticated trading tools, their efficacy depends on the quality of data inputs, algorithmic sophistication, and risk management protocols implemented by traders. As the capabilities of AI continue to evolve, its integration into cryptocurrency trading is expected to reshape market dynamics and redefine the boundaries of trading efficiency and innovation.

Conclusion: Technical analysis is a valuable tool for traders seeking to analyze price data and make informed decisions in the financial markets. By mastering the basics of charts, candles, and trading patterns, traders can gain a deeper understanding of market dynamics and identify potential trading opportunities with confidence. It's essential to conduct thorough research, practice risk management, and continuously improve your technical analysis skills to succeed in trading.